Monthly beats annual – why agile portfolio management drives growth

08 Aug 2025

Blog

Your annual portfolio review is already out of date. By the time you've analysed last year's performance, validated the insights, and built next year's plans, the market has moved. Consumer preferences have shifted, competitors have launched new products, and regulations have changed.

Yet most organisations still treat brand and portfolio management like an annual ritual: a comprehensive deep dive that happens once a year generates a thick presentation and gets filed away until the next time. Meanwhile, they hold monthly meetings to debate demand forecasts for products they know need fundamental changes.

The approach is wrongheaded. While marketing and portfolio decisions happen annually, demand forecasting occurs monthly, yet marketing and portfolio strategies shape demand, not the reverse. Leading organisations have figured this out: they've moved marketing and portfolio management from annual events to monthly discipline.

This shift recognises that marketing and portfolio relevance degrade faster than ever in volatile markets. The companies winning today treat brand and portfolio health like financial health: something you monitor continuously, not just during an annual check-up.

The difference between reactive portfolio management and proactive portfolio optimisation often determines which companies thrive and which merely survive.

Annual reviews miss the market pulse

Traditional portfolio reviews follow a predictable pattern: gather data from the past 12 months, analyse performance against targets, identify problem products, debate solutions, and build plans for next year. The process takes months, and the insights arrive too late.

Consider what happens during those months of analysis. Market conditions continue evolving, consumer behaviour shifts, and competitive pressures intensify. By the time you've completed your comprehensive review, you're looking at a market that has fundamentally moved on or, at worst, no longer exists.

The major flaw in annual portfolio planning is treating markets as stable. Annual reviews assume that last year's performance insights will guide next year's strategy. But markets don't wait for planning cycles.

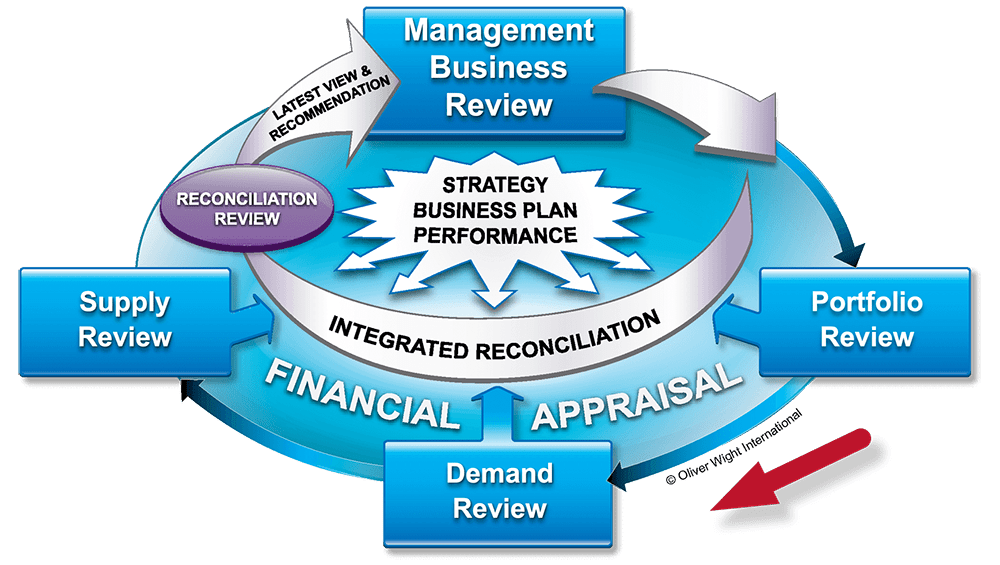

Market-leading organisations understand this reality. They've integrated annual portfolio events into the monthly Portfolio Reviews as the first step in their Integrated Business Planning (IBP) process. They align on portfolio strategy before teams start forecasting demand or planning supply.

This monthly discipline creates something annual reviews cannot: market responsiveness. When consumer and customer preferences shift, portfolio strategy adapts within weeks, not quarters. When competitors launch new products, response plans activate immediately, not at the following annual review.

Monthly portfolio management transforms planning from historical analysis to strategic foresight. Instead of asking, "How did our products perform last year?" teams ask, "How must our portfolio evolve to win in changing markets?"

Figure 1: Monthly Integrated Business Planning cadence, starting with the Portfolio Review

Cross-functional alignment accelerates decisions

The most significant advantage of monthly portfolio management isn't just frequency but integration. Annual portfolio reviews typically involve marketing and product teams working in isolation and then presenting recommendations to leadership for approval.

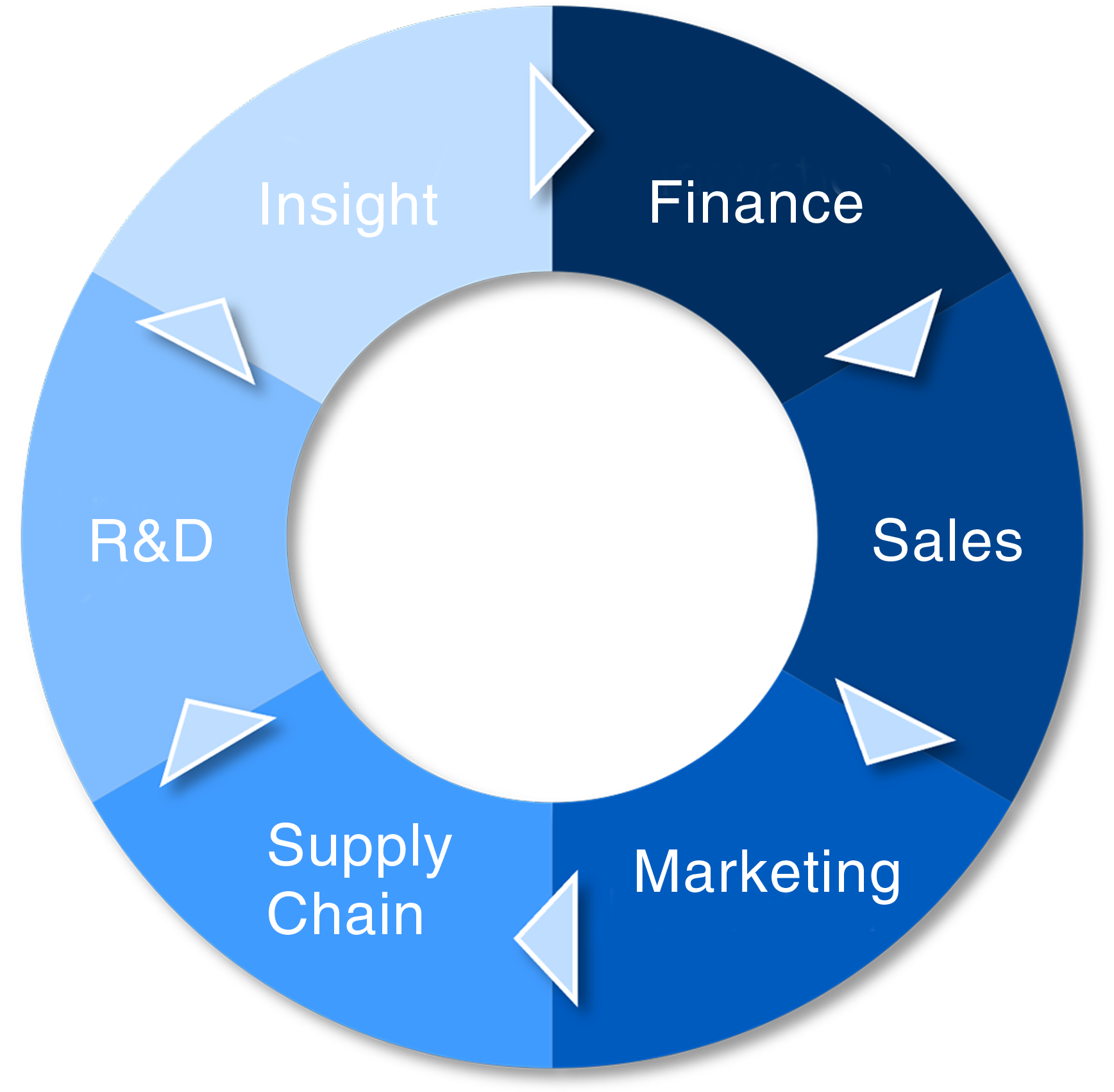

Monthly Portfolio Reviews work differently. They combine cross-functional teams – marketing, product development, sales, supply chain, and finance – to make decisions collectively. This eliminates the traditional handoff delays that kill agility.

Figure 2: Required business inputs and validation to maintain a healthy portfolio now and in the future

But the real power lies in human dynamics. When diverse functions gather monthly, they build trust through regular interaction. Marketing learns to appreciate supply chain constraints, and finance understands customer realities. This familiarity creates psychological safety, where teams can challenge each other's assumptions without damaging relationships.

The monthly rhythm allows for productive conflict, the kind that improves decisions. When marketing proposes a line extension, the supply chain team can immediately flag complexity costs. When finance questions margin assumptions, sales can provide customer context. This constructive tension, managed within trusted relationships, leads to better decisions than any single function could make alone.

When portfolio decisions require cross-functional alignment, monthly cycles enable real-time coordination. Marketing identifies emerging consumer trends. Product development assesses technical feasibility. The sales department evaluates customer acceptance. Supply chain determines operational implications. Finance validates business cases.

This integration prevents the classic portfolio planning failure: brilliant strategies that prove impossible to execute. By involving all functions in monthly decision-making, portfolio changes become executable from day one.

Cross-functional monthly reviews also share portfolio intelligence across the organisation. Rather than marketing owning a portfolio strategy while other functions react to decisions, every function contributes insights and owns outcomes. This shared accountability accelerates both decision-making and execution.

The result is that portfolio changes that might take six months under annual planning happen in six weeks under monthly discipline.

Active optimisation beats reactive firefighting

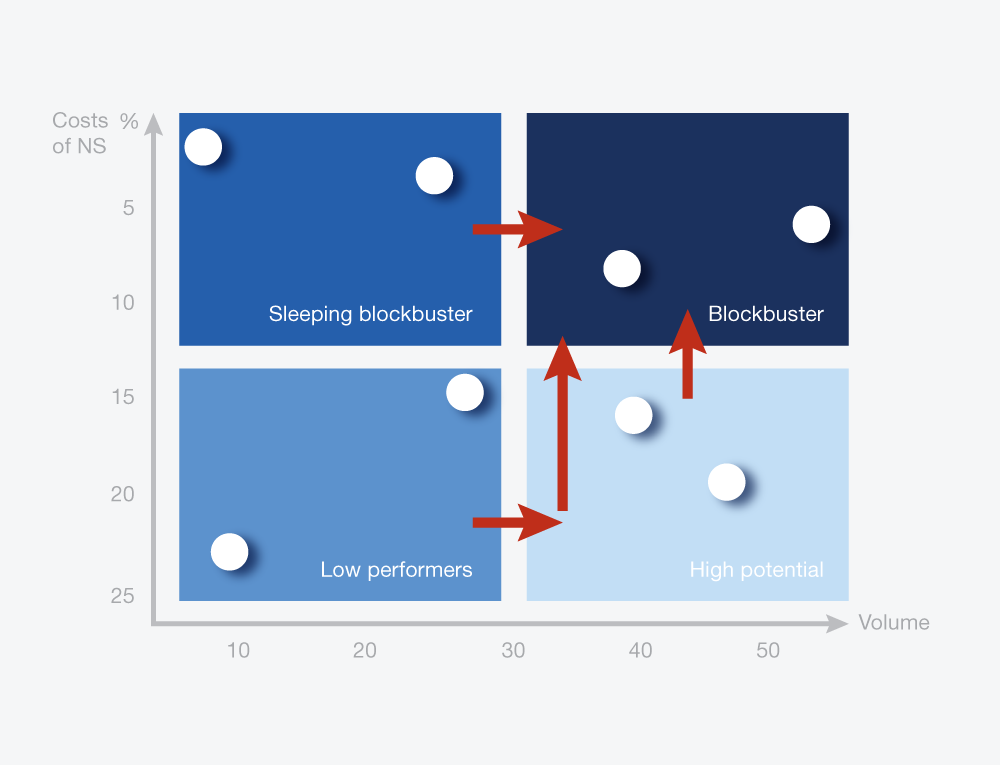

The most transformative aspect of monthly portfolio management is shifting from reactive problem-solving to proactive optimisation. Annual reviews excel at identifying problems after they've impacted performance, while monthly reviews prevent issues before they materialise.

This requires different thinking. Instead of analysing why products underperformed, monthly reviews ask why products might underperform. Instead of reacting to competitive threats, they anticipate competitive moves. Instead of responding to market changes, they position for market evolution.

Monthly portfolio reviews use frameworks like Product Quadrant Analysis to categorise products by performance and potential. "Blockbusters" get investment priority. "Sleeping blockbusters" get activation plans. "Problem children" get improvement timelines or deletion schedules. This systematic approach prevents portfolio drift.

Figure 3: Product Quadrant Analysis (PQA)

The monthly discipline also enables assumption management. Portfolio strategies rely on assumptions about market growth, consumer behaviour, competitive dynamics, and internal capabilities. Annual reviews treat these assumptions as fixed, while monthly reviews treat them as hypotheses to be tested and updated.

When assumptions prove wrong, monthly cycles enable rapid course correction. When new opportunities emerge, monthly reviews provide a mechanism for evaluation and response. When external factors change – regulatory shifts, economic volatility, technological disruption – portfolio strategy adapts accordingly.

This creates genuine organisational agility – not the ability to react quickly to problems, but the ability to evolve continuously toward opportunities while simultaneously managing and mitigating key risks.

Monthly portfolio management transforms organisations from firefighters responding to crises into architects designing competitive advantage. The companies making this transition aren't just managing their portfolios more effectively – they're reshaping their markets more deliberately.

The shift from annual to monthly portfolio management represents more than operational improvement. It signals strategic intent: the decision to actively shape market position rather than passively respond to market forces.

Organisations still conducting annual portfolio reviews while competitors optimise monthly are more than behind in process: they're competing with outdated information against real-time intelligence.

Learn the complete framework for monthly portfolio management.

Read our Portfolio Review white paper to discover how leading organisations optimise value through continuous portfolio discipline.

Author(s)

-