Why portfolio planning must come before demand forecasting

31 Jul 2025

Blog

.jpg)

Marketing teams spend months crafting brilliant campaigns that fail to increase market share or customer retention beyond 12 months. The problem isn't the creative work: marketing responds to demand forecasts instead of creating them.

The macroeconomic turbulence of recent years has pushed marketing and portfolio teams into an impossible position. Supply chain disruptions, inflation, and geopolitical uncertainty have shortened planning horizons just when brands need longer-term thinking most. The natural response? React to whatever crisis demands attention today.

Yet while most marketing organisations have been managing today's challenges, a small group of forward-thinking companies has been quietly building advantage through Integrated Business Planning (IBP). They've realised something counterintuitive: marketing and portfolio strategy should drive business planning, not respond to it.

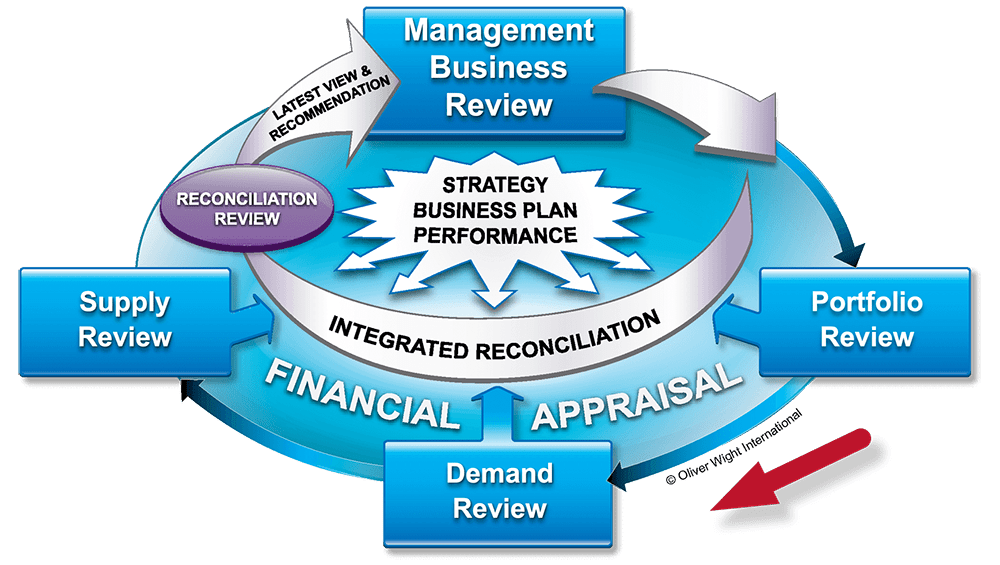

IBP represents a profound evolution beyond traditional Sales and Operations Planning (S&OP). Where S&OP focuses on balancing supply and demand, IBP integrates portfolio strategy, innovation management, and commercial execution into a unified process that starts with the Portfolio Review.

Figure 1: Monthly Integrated Business Planning cadence, starting with the Portfolio Review

This approach radically rethinks how marketing, product development, and commercial strategy connect. Traditional S&OP follows a familiar sequence: forecast what customers will buy, then determine how to make and deliver it. But what if that's backward?

Consider what happened to Woolworths and HMV. Both companies had advanced forecasting systems and data analytics. Both could predict sales with reasonable accuracy. Neither saw the strategic shifts coming that would make their entire business models irrelevant. They were excellent at forecasting product demand that consumers would soon stop wanting.

The lesson? Demand planning without a portfolio strategy is like navigating by looking in the rear-view mirror. You can see where you've been but are blind to where you're headed.

Firefighting today kills tomorrow's growth

The current business environment has amplified a dangerous tendency: the more immediate the pressure, the shorter your planning horizon becomes. When supply chains are fragile, and costs are volatile, quarterly targets dominate strategic thinking. Companies defer investment in future portfolio development. Companies raid innovation pipelines to fill short-term gaps.

This scenario forms a vicious cycle: quarterly pressure starves new product development; fewer launch options increase pressure on existing products; squeezing more from aging portfolios shortens planning horizons to months instead of years. Before long, you're trapped in a declining spiral of firefighting.

The companies pulling ahead right now understand this trap. They've maintained focus on portfolio strategy even during turbulent times. They ask different questions:

- What products and services will our customers need in three years?

- Which market segments are we positioned to win in?

- What capabilities must we build to compete effectively?

These practical business questions should drive every planning cycle. Yet most organisations bury them in annual strategic reviews while focusing monthly planning meetings on demand forecasts and supply constraints.

The reality is that if you're not actively shaping your portfolio for the future, market forces are shaping it for you. And market forces don't care about your profit margins.

Portfolio strategy drives demand, not the reverse

Traditional business planning follows a logical sequence: forecast demand, plan supply, balance resources, and manage constraints. It's neat, structured, and flawed.

The flaw lies in treating demand as independent of portfolio decisions. In reality, demand is primarily determined by what you offer, how you position it, where you sell it, and how you price it. These are portfolio decisions, not demand forecasts.

Consider a simple example: if you discontinue a low-performing product variant, demand for that variant drops to zero. If you launch a compelling new product, you build demand that didn't previously exist. If you reposition an existing product for a different market segment, demand patterns shift completely.

Traditional demand forecasting, which assumes a static portfolio, cannot capture these changes. It requires portfolio-first thinking.

Hence, companies using IBP start with the Portfolio Review as step one. Before anyone starts forecasting demand, cross-functional teams align on portfolio strategy. They agree on which products to emphasize, which to phase out, and which new offerings to introduce.

Only then do they build demand plans. But these aren't passive forecasts based on historical patterns. They're active plans based on portfolio strategy and market assumptions. The difference is profound.

Portfolio-first planning delivers the "triple win": customers get more relevant products, consumers receive better value, and companies achieve higher margins and faster growth. Traditional demand-driven planning serves none of these stakeholders effectively.

Building assumptions that underpin future success

The sophisticated aspect of portfolio-first planning is the assumptions it creates. While traditional planning extrapolates from historical data, portfolio planning builds explicit assumptions about future market conditions, consumer behaviour, and competitive dynamics.

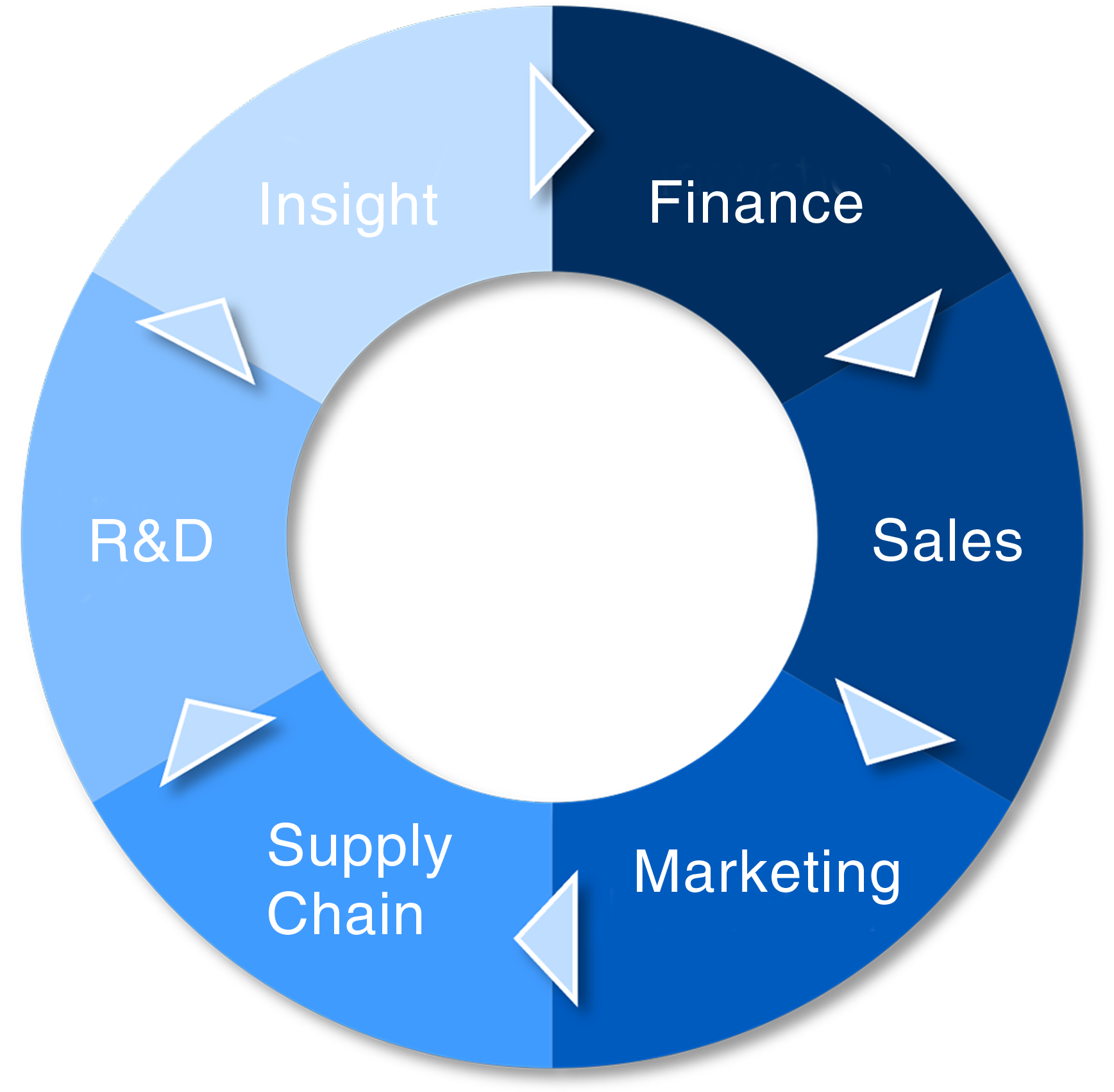

Figure 2: Required business inputs and validation to maintain a healthy portfolio now and in the future

The assumptions extend beyond external market factors to internal capabilities: new development competencies, strategic partnerships to pursue, and route-to-market evolution.

Most importantly, these assumptions are transparent and updated regularly. When market conditions change, the assumptions change, and the portfolio strategy adapts accordingly. This approach generates greater agility, and the ability to respond quickly to new information without losing coherence.

Traditional planning systems struggle with this adaptation because they're built around extrapolation rather than assumption management. When external conditions shift, the planning system breaks down because it has no mechanism for incorporating change.

Portfolio-first planning embraces uncertainty by making assumptions explicit and manageable. This doesn't eliminate uncertainty. Nothing can do that. But it turns market uncertainty into a strategic advantage.

The organisations thriving in today's markets aren't those with the best demand forecasts. They're those with clear product roadmaps, market positioning, and agile assumption management processes.

The shift from demand-driven to portfolio-driven planning is about recognising that marketing and product strategy should drive business planning, not respond to it. In an uncertain world, the companies that shape their markets outperform those that respond to them.

Ultimately, companies that still forecast demand before defining portfolio strategy are planning for yesterday's market while competitors design tomorrow's.

Discover how to implement portfolio-first planning in your organisation.

Read The IBP advantage white paper series to transform your planning approach and drive sustainable growth.

Author(s)

-