Marketing teams: Beware the silent profit drain hiding in plain sight

22 Aug 2025

Blog

Chances are, your total portfolio is far more complex than it needs to be. While marketing teams obsess over new product launches, and sales teams chase revenue targets, profit quietly bleeds from the significant portion of products that shouldn't exist.

Portfolio complexity is the silent killer of business performance. Unlike supply chain disruptions or competitive threats, it doesn't announce itself. It accumulates slowly, product by product, variant by variant, until organisations find themselves managing thousands of stock-keeping units (SKUs) that collectively confuse customers and destroy margins.

The mathematics is brutal: managing complex portfolios costs exponentially more than managing focused ones. Production runs get shorter, inventory costs multiply, and sales teams spread attention across too many products. Meanwhile, marketing budgets can fragment across countless campaigns, and customer decision-making becomes paralysed by choice.

Yet complexity continues growing because the costs remain hidden while the benefits seem obvious. Every new product launch promises incremental revenue. Every market segment demands specific solutions. Every customer relationship requires customised offerings.

Smart organisations have learned to distinguish between profitable complexity and expensive complexity. They use systematic approaches to identify which products drive growth or drain resources. The difference between these two types of complexity often determines competitive advantage.

Complexity costs more than you think

The visible costs of portfolio complexity – manufacturing setup times, inventory holding costs, and marketing spend allocation – represent only a fraction of the total impact. The hidden costs dwarf what appears on financial statements.

Consider customer confusion. Research consistently shows that excessive choice reduces purchase likelihood and satisfaction. Customers who face too many options delay decisions, choose nothing, or select familiar brands regardless of value. Your complex portfolio doesn't capture more demand; it fragments existing demand across unprofitable variants.

Sales force effectiveness deteriorates with portfolio complexity. Sales teams spread attention across numerous products, becoming generalists rather than specialists. They struggle to articulate value propositions for hundreds of variants. Customer conversations become superficial because depth requires focus.

Elsewhere, supply chain costs escalate exponentially, not linearly, with complexity. Each additional SKU increases forecasting difficulty, inventory requirements, and operational overhead. The cumulative impact often exceeds the direct costs by multiples.

Marketing efficiency collapses under complexity. Campaign budgets spread thin across numerous products deliver a weak impact. Brand messages can become diluted or simply missed. Marketing teams waste time coordinating across fragmented portfolios instead of building focused brand propositions.

Perhaps most damaging, complexity obscures performance visibility. When portfolios contain hundreds of products, identifying problems becomes difficult. Weak performers hide behind strong ones, and resource allocation becomes guesswork rather than strategic choice.

Organisations often discover that eliminating their worst-performing products increases total profitability while significantly reducing operational complexity.

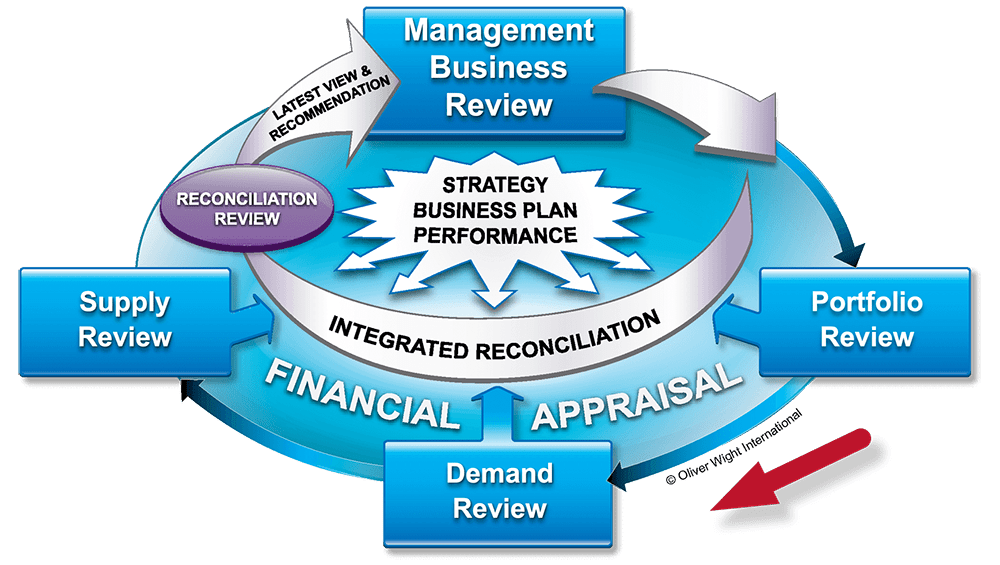

Figure 1: Monthly Integrated Business Planning cadence, starting with the Portfolio Review

Sleeping blockbusters need wake-up calls

Not all underperforming products deserve elimination. Some require strategic intervention to unlock hidden potential. Multidimensional analysis helps distinguish between genuine failures and sleeping blockbusters.

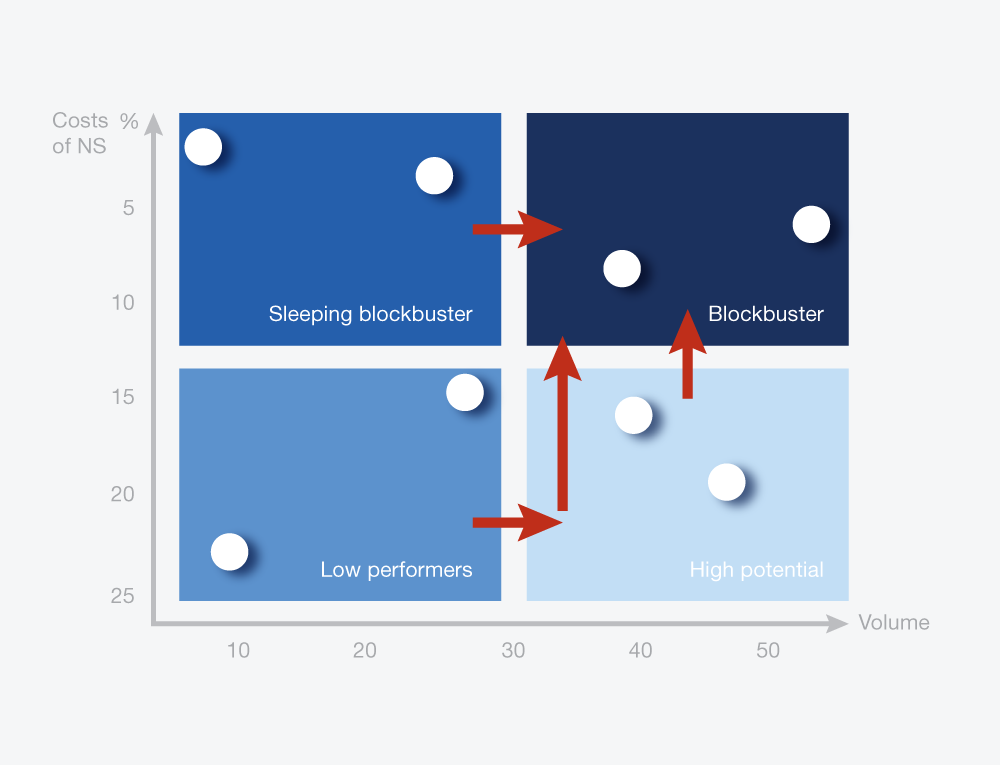

For example, Portfolio Quadrant Analysis is a model that creates four clear categories to segment your portfolio. It plots products across two dimensions: volume performance and cost efficiency. This creates four categories: blockbusters (high volume, low cost), high potential products (low volume, low cost), low performers (low volume, high cost), and sleeping blockbusters (high volume, high cost).

Figure 2: Product Quadrant Analysis (PQA)

Blockbusters obviously deserve continued investment. Low performers typically require elimination unless strategic factors demand retention. The interesting categories are high-potential products and sleeping blockbusters.

High-potential products show cost efficiency but lack volume. To realise potential, they often require marketing investment, channel expansion, or repositioning. The key question is: What prevents current low volume, and can intervention cost-effectively address barriers?

Sleeping blockbusters achieve volume despite cost inefficiency. Something about these products resonates with customers, but operational execution undermines profitability. These products often offer the highest improvement potential through supply chain optimisation, pricing adjustment, or specification refinement.

Deeper analysis reveals that portfolio optimisation models that apply narrow financial metrics miss the mark. Products generating strong revenue might destroy value through complexity costs. Products showing weak revenue might become profitable with modest operational improvements.

Smart portfolio management focuses resources on moving products toward the blockbuster quadrant rather than simply eliminating weak performers. This requires understanding why products occupy current positions and what interventions might improve positioning.

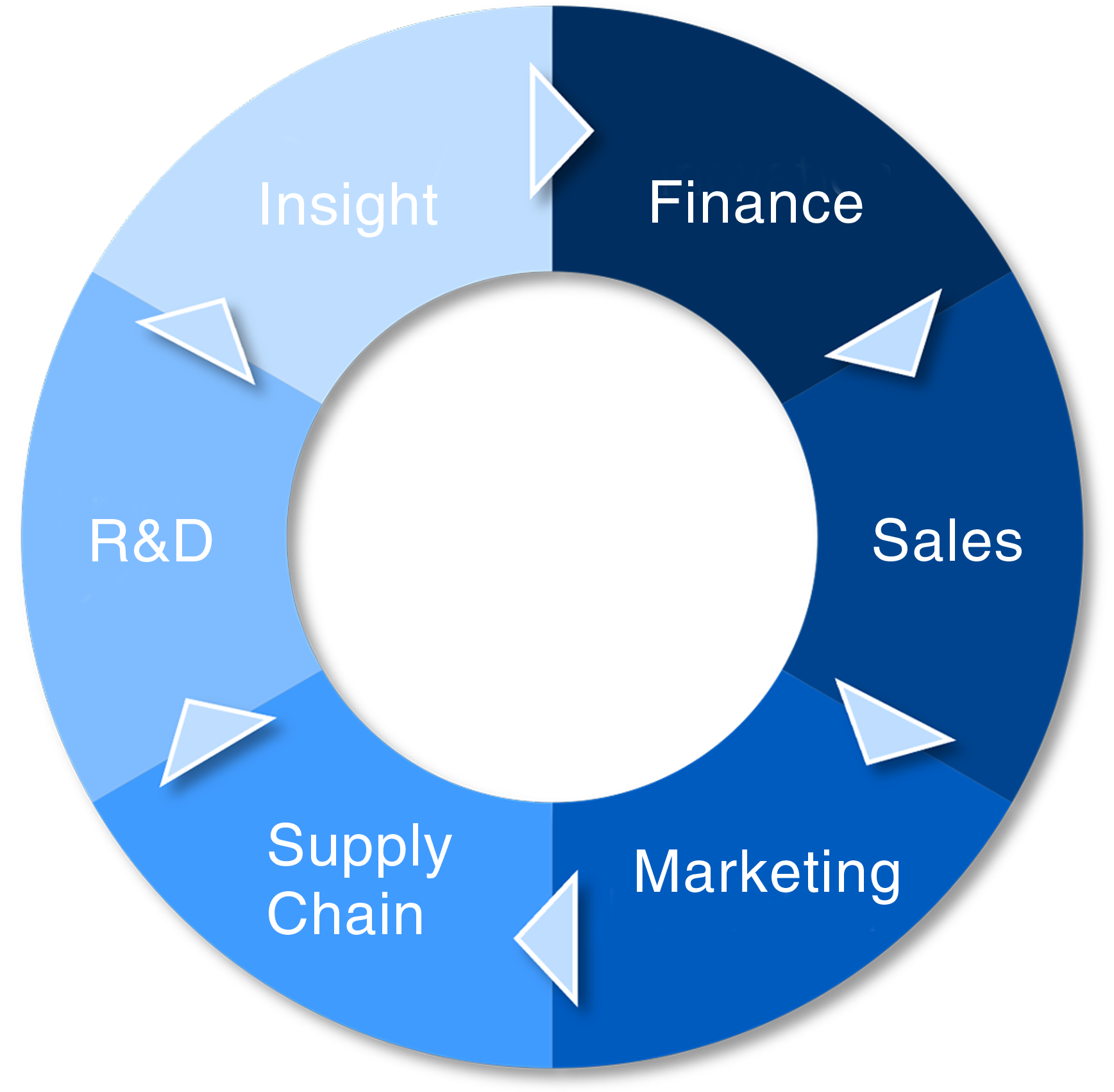

Figure 3: Required business inputs and validation to maintain a healthy portfolio now and in the future

The goal isn't only portfolio reduction; it's portfolio optimisation. Sometimes, fewer products deliver better results, and often, the same products with better execution generate superior outcomes.

Strategic deletion drives profitable growth

The most counterintuitive aspect of portfolio optimisation involves strategic deletion. Marketing instincts resist eliminating products because elimination feels like reducing options and opportunities, yet strategic deletion often increases both.

Eliminating weak products concentrates resources on strong ones. Marketing budgets focused on fewer products deliver a more substantial impact. Sales teams develop deeper expertise. Supply chain efficiency improves through volume concentration. Customer choice becomes clearer rather than overwhelming.

Strategic deletion also enables strategic addition. Resources freed from supporting weak products can fund the development of stronger ones. Manufacturing capacity released from complex variants can support higher-volume products. Marketing attention redirected from failures can build blockbuster brands.

The keyword is strategic. Random elimination creates gaps. Strategic deletion creates focus. This requires understanding why products exist, their purposes, and whether alternatives can serve them more effectively.

Some products exist for strategic reasons despite weak financial performance. Defensive products prevent competitive entry. Portfolio completeness products reassure customers about comprehensive solutions. Gateway products introduce customers to broader offerings.

These strategic roles matter, but they shouldn't excuse poor execution. If defensive products fail to deter competition, they're expensive and not strategic. If completeness products confuse rather than reassure customers, they're counterproductive. If gateway products don't lead customers to higher-value offerings, they're low-margin distractions.

Portfolio optimisation requires an honest assessment of whether products deliver intended strategic value or merely consume resources while providing strategic alibis.

Organisations that master strategic deletion improve profitability and accelerate growth by concentrating resources on opportunities with genuine potential rather than spreading investment across hope and habit.

The companies thriving in competitive markets aren't those with the most products. They're those with the right products, adequately supported, clearly positioned, and efficiently delivered.

Complex portfolios feel comprehensive but often deliver confusion. Focused portfolios feel constrained but typically deliver clarity, efficiency, and superior customer value.

Ultimately, your portfolio is a mirror of your strategy. Complex portfolios reflect scattered priorities, while focused portfolios reflect strategic discipline. What does your portfolio say about your strategy?

Discover how to optimise your portfolio for profitable growth.

Download our portfolio management white paper for the complete Product Quadrant Analysis framework and strategic deletion methodology.

Author(s)

-